By Wisdom Deji-Folutile

The federal government’s ban on Cryptocurrency transactions in Nigeria’s financial industry has done little to slow down the youthful population who rely on it to make ends meet. In fact, Nigeria is one of the biggest markets for cryptocurrency trading in the world today.

Although there are many sceptics, companies like Tesla, Paypal and more have rallied support for cryptocurrencies. And now, Nigerian business owners, vendors and entrepreneurs also use cryptocurrencies like bitcoin and ethereum to receive payments for services.

Yet, while so many seem to be thoroughly convinced of the usefulness of these intangible coins, many Nigerians remain in the dark on how cryptocurrencies work, why they are being heavily traded, and why the government does not encourage it.

FRANKTALKNOW has set up an explainer to help understand cryptocurrency in relatable terms.

What is Cryptocurrency?

Cryptocurrency is a virtual currency based on a decentralised ledger (blockchain) secured by cryptography. It may sound like gibberish, but the terms will be all addressed soon. What this means is that cryptocurrencies like bitcoin and ethereum are digital currencies – electronic means of storing value – that can be used for trading goods and services.

According to Forbes, there are over 5,000 cryptocurrencies in the world today. Some estimates say there may be as many as 15,000. However, bitcoin is the most popular, as it was the first, and it is also the most expensive.

Cryptocurrency was established in 2009 when an unknown programmer, Satoshi Nakamoto, released a white paper stating he had founded an electronic payment system based on ‘proof instead of trust’.

What Nakamoto simply meant was that fiat money (like the cash notes used in most parts of the world today) relies heavily on centralised banking systems like the Central Bank of Nigeria to determine the value of money based on the declaration. Banks also facilitate the transactions involved in cash spending, saving and investing.

Hence, people needed to trust banks when making use of fiat money. However, one does not need to ‘trust’ a bank with cryptocurrencies, as the system is almost entirely foolproof.

In order to buttress the point of what cryptocurrencies are, we should talk more about a term called ‘blockchain’.

What is a blockchain?

A blockchain is a distributed ledger of records that people can use to track contracts, money, trade and more. It is where cryptocurrency transactions are created and managed, but we’ll get back to that in a second.

Remember that bitcoin is still just money and one of the reasons we keep money in banks is for managing transactions in a meticulous way. However, with bitcoin, there are no banks to monitor or authenticate transaction requests. Also, banks like the Central Bank issue and print fiat cash, but who issues and mints bitcoin? So, for now, just look at the blockchain as a replacement for the banking system.

Most banking systems in the world use a ledger system to track transactions. However, the downside is that the methods used to track these transactions are centralised. This means that banks and financial institutions are regularly left with total control over transactions, leading to mismanagement, risk of central attacks, and increased corruption.

Because of this, one thing that makes the concept of the blockchain important is that it is decentralised – a peer-to-peer network. This means that no one person has autonomous control over the ledger records on the network.

READ ALSO: Twitter Founder, Jack Dorsey Appoints Three Nigerians To Head Bitcoin Trust Fund

Hence, records are not easily altered because everybody on the blockchain network has a copy of the ‘blocks’ of records in the blockchain. These records are all updated once any change is made, and all made changes must first be vetoed by the majority of the network. For the sake of illustration, let’s take a very loose analogy and use it to explain the concept.

Say in the Nigerian context that all the countries’ bio records were housed on a blockchain and that all Nigerians were part of the network, then we would have a record of everybody’s information – their birth dates, health status, etc.

Now, in a country that records massive cases of corruption every year, it is not unusual to see public servants alter their birth records in order to compete in elections where they’d have otherwise exceeded the age limit. It is also not uncommon to see civil servants alter their ages in order to push retirement away, and so on.

However, if birth records were on the blockchain, simply adjusting the documents would be significantly difficult to do. This would mean that a majority of the network members (in this case, the majority of Nigerians) would have to approve that change. And if they do not, the change cannot be effected on the blockchain as a whole.

Hence, such politicians may be able to falsify their own records on their ledgers, but every other Nigerian would be able to tell that the information was just altered and had not been there from the start – because the records will clearly show that and will not update until a majority of the network agrees to effect the change. This is why we call it decentralised.

In the normal world system of spreadsheet ledgers, one person/organisation has access to altering or maintaining the spreadsheet, so if that organisation can be compromised, the entire ledger can be compromised, and no one would be able to track past records or correct the manipulated information.

So, back to bitcoin.

What is bitcoin, and how do people get it?

Bitcoin was the first cryptocurrency and has remained the most popular option. Some buy it with money (just as one buys dollars with pounds or naira).

Some receive it as payment for a service, and some earn it from crypto mining.

What is Crypto Mining?

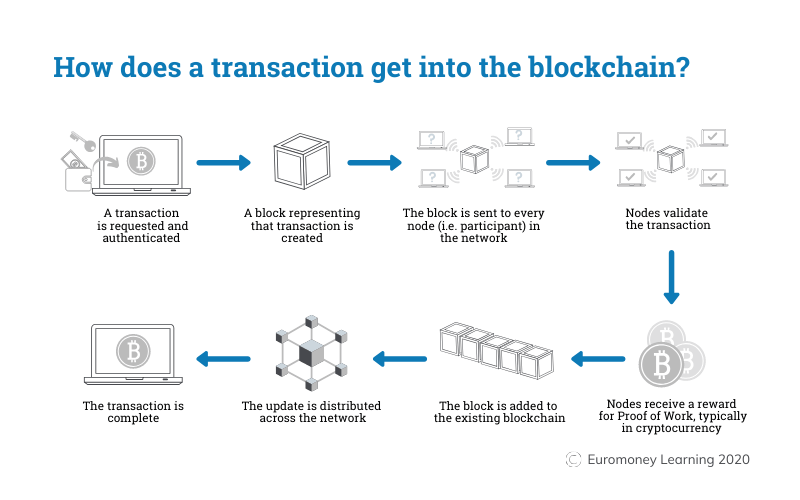

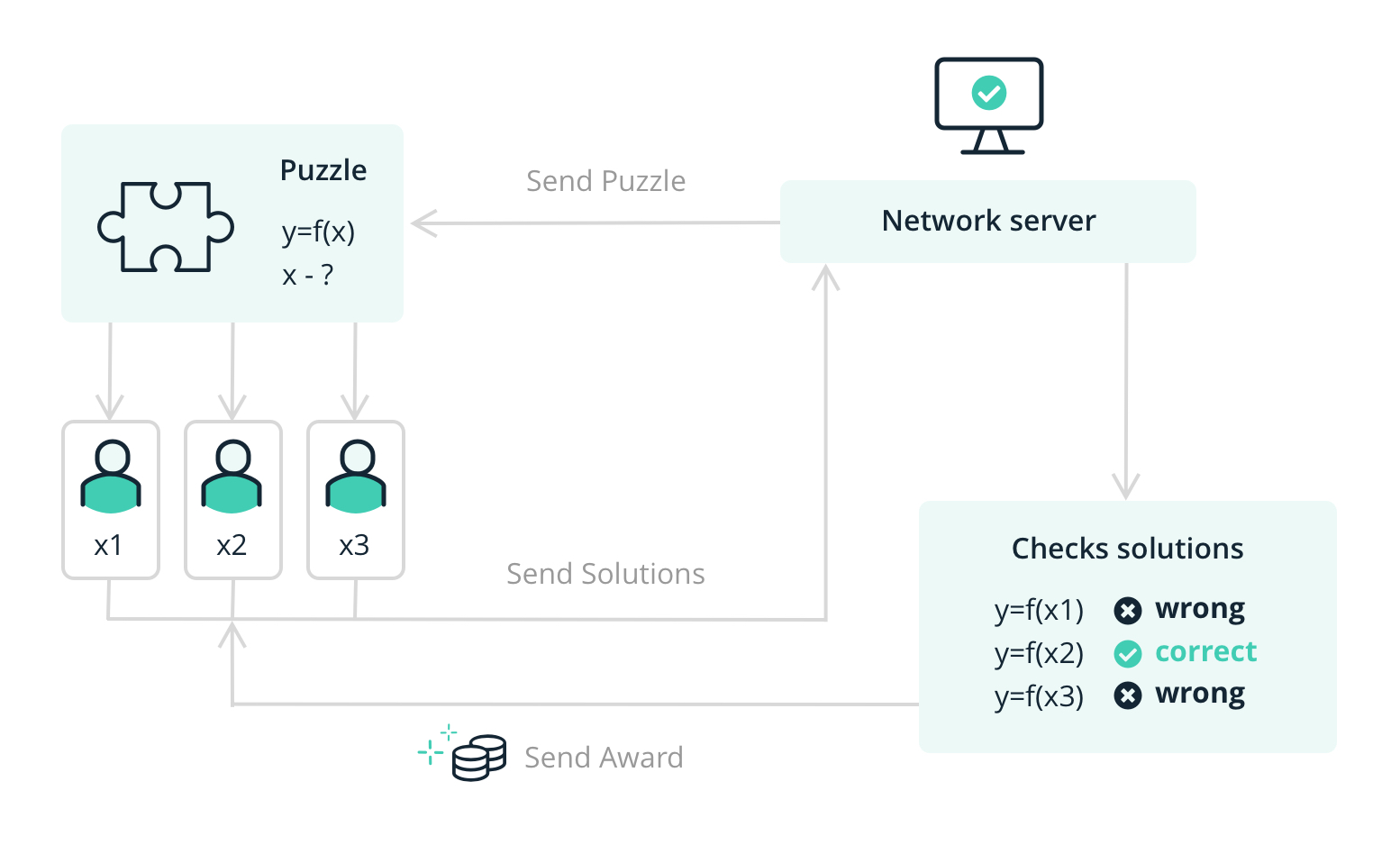

This is difficult to explain without using jargon terms, but when two users of cryptocurrency want to facilitate a transaction, they need the transaction to be verified and authenticated. The process of verifying these transactions is called proof of work.

And how it works is this:

Remember we stated earlier that a blockchain is a distributed ledger, and for a change in a distributed ledger to be effected, the majority of systems on the network must agree to that change. Also, remember that the systems on a public blockchain that manage these ledger changes and authenticate transactions are owned by real human beings. Hence these people have systems working round the clock to authenticate transactions and manage the ledger.

The computers on the network need to solve a complex mathematical problem to add the ‘block’ of the transaction to the ‘chain’ of the ledger. But, the odds of solving the problem are about 1 in 5.9 trillion, meaning the miners need very powerful systems to process this at a fast rate as the problem can only be solved using trial and error. This process is tedious and so the owners of the systems that manage this process are incentivised to verify transactions by getting ‘paid’ in cryptocurrency for solving the mathematical problem.

So, all that we just explained above is the process of crypto mining. It seems like everybody should just quit their day jobs and become miners for something worth more than gold, right?

Well, the process of ‘mining’ for cryptos like bitcoin is so tedious and requires so much computing power and electricity that it’d probably cost you more in the long run. So, this is how cryptocurrencies like bitcoin regulate themselves, in that new coins cannot easily be made, which makes them scarce and helps them stay expensive.

Is bitcoin secure?

Because of the nature of the currency, bitcoin is a lot more secure than conventional currency.

What makes cryptocurrency different from a digital currency, like say, e-Naira?

The two things are not the same at all. E-Naira is not based on a decentralised network. The CBN can monitor the e-Naira because it is linked directly to your Bank Verification Number and your existing bank accounts. So the CBN can regulate transactions, seize and freeze e-Naira accounts, seeing as the platform is centralised. Whereas, cryptocurrency platforms are decentralised.

Possible advantages of crypto to Nigeria

Bitcoin has promising potential for Nigerians. However, the Nigerian government has been critical of it and banned it, citing reasons we will touch on in the next section.

One example of the possibilities available in crypto is low bank charges, as cryptocurrency removes the need for the middleman – banks and other financial institutions.

Another example of why Nigerians prefer to make use of cryptos is because they are not regulated by the government. Cryptocurrency replacing conventional money could also help reduce the problem of corruption and mismanagement in financial institutions.

Also, people who don’t have access to the banking system can take advantage of cryptocurrencies.

Possible disadvantages

Like with anything else, there are downsides to the use of cryptocurrencies. One reason is that banks and the government do not regulate them, which means that the government can’t help you trace your money should you lose it.

Another big problem with cryptocurrency is that people can use it to conduct crimes since it is fundamentally pseudo-anonymous, making it an obvious choice for use on the dark web by unscrupulous people.

Volatility is also a problem that the CBN and the Bank of England have publicly spoken against. Day trading, a popular method used by Nigerians to buy and sell their crypto investments, makes the process of investing in bitcoin more akin to gambling than actual investment. This is because many Nigerians who buy crypto do not keep it for its long-term value or even understand how market forces affect their prices. The currency is so volatile, so the practice of buying at lows and selling at highs on a daily basis is very popular.

Cryptocurrency could also pose other problems to the environment. Remember what we said about the mining of bitcoin? It takes a lot of power to operate the machines that maintain the ledgers, cool the machines, and so on, which may be unsustainable in environmental terms.

However, it remains to be seen how disadvantageous the energy effects of bitcoin are to the environment when compared to conventional banking power usage.

Another problem with cryptocurrency is security. Although cryptocurrency itself is a lot more secure than banking ledgers, people use apps like Binance and Coinbase to purchase, sell and store their cryptocurrencies. Hence, losing passwords, having accounts hacked and entire platforms hacked, and things of that nature pose a problem to crypto use.