The Minister of Finance and Coordinating Minister of the Economy, Olawale Edun, has announced that the $500m domestic FGN US dollar bond will enhance external reserves and help stabilize the foreign exchange situation in the country.

Speaking at a hybrid roadshow in Lagos on Thursday, Edun said the bond issuance aims to increase the flow of dollars into the economy, which will attract foreign portfolio investments and foreign direct investments. He noted that Nigeria’s external reserves currently stand at $36.62bn, according to Central Bank of Nigeria data.

The bond, which has a tenor of five years and a minimum investment of $10,000, targets Nigerians, non-Nigerians residing in the country, and Nigerians in the diaspora. Repayment will be made in US dollars, preserving value for investors. The bond will be listed on the FMDQ and Nigerian Exchange Limited.

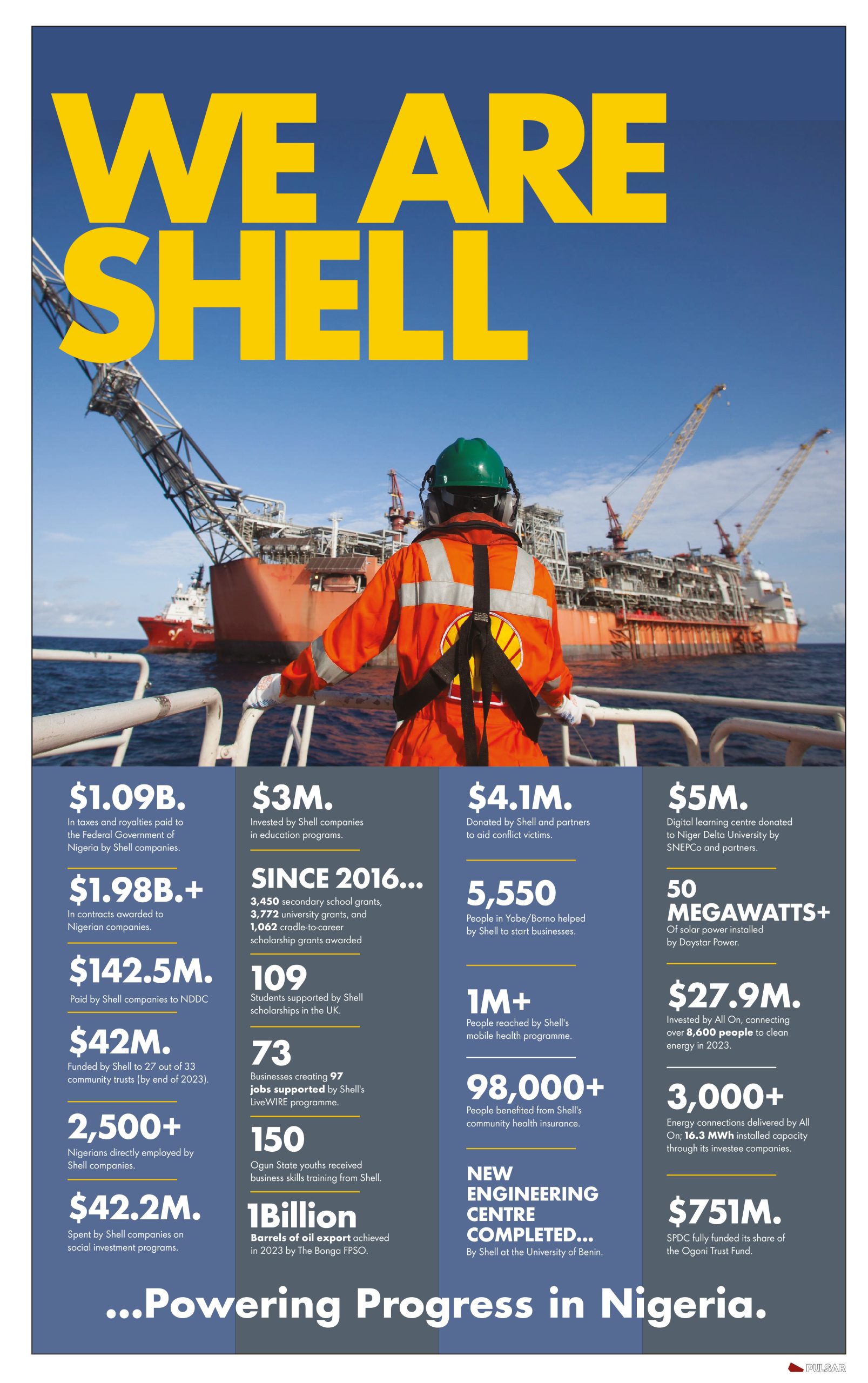

Edun emphasized that the combination of monetary and fiscal policies has attracted foreign portfolio investments and increased foreign direct investments, particularly in the oil and gas sector. He added that higher reserves and a stronger exchange rate can reduce inflation and interest rates, creating opportunities for borrowing, investing, and job creation.