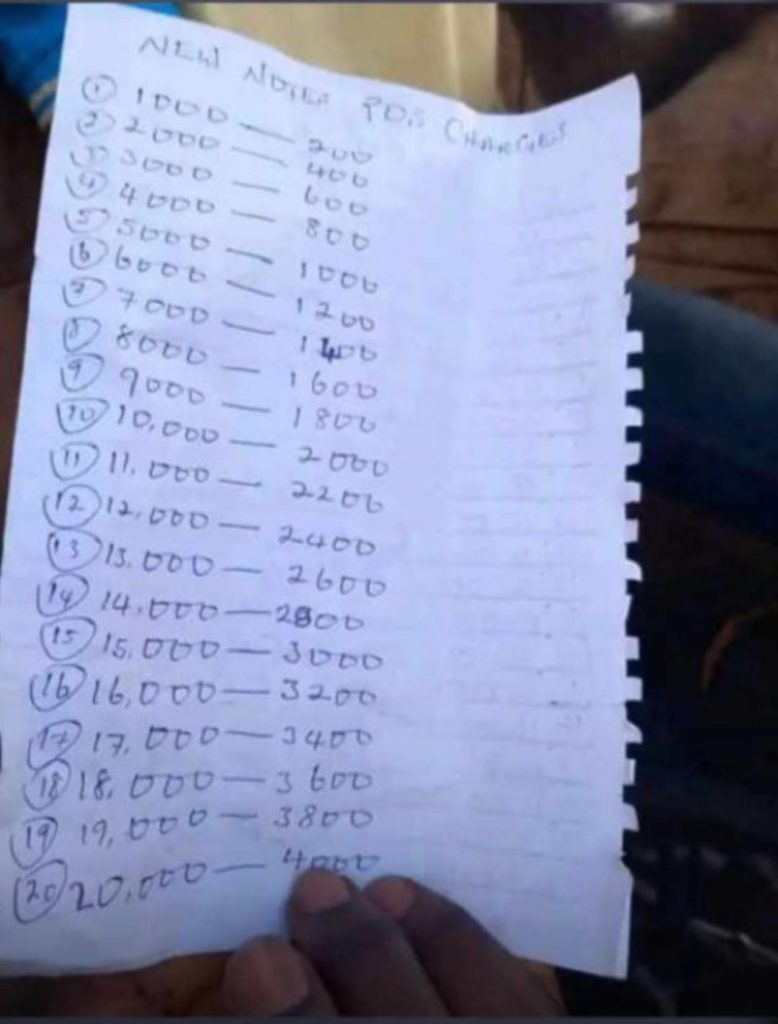

As the scarcity of the redesigned Naira notes persists, Nigerians have expressed their agony with POS operators now charging ₦1,000 for a withdrawal of ₦5,000, and N5,000 for ₦20,000.

This is happening as bank apps and USSD codes have failed to help complete customers’ transactions.

Since the directive of the Central Bank of Nigeria that old naira notes should be swapped to new notes, Nigerians have been lamenting the challenges involved in the process despite the extension to February 10, 2023.

“I had to stay up at midnight to do a transaction of groceries I was forced to buy,” Mr. Alade Adeleke told our correspondent in the Ikotun area of Lagos.

A carpenter, Mr. Rasheed Ilori lamented trekking from Pako Market in Isolo to Mushin on Thursday looking for cash on ATMs and at mobile bank operators, popularly called POS.

Rasheed said “There’s no cash anywhere. This morning now, I’ve been to all ATMs, but no cash. I and my partner we’ve trekked from here (Isolo) down to Mushin, looking for cash to complete a job, all to no point.”

“Transfers are also not going through and it’s all very frustrating.”

Rasheed lamented further that “POS operators now charge ₦1,000 for withdrawal of ₦5,000, and N5,000 for ₦20,000.

According to some bank customers who spoke with our correspondent, since the beginning of the week, the major banks are mainly affected.

Nigerians have now become stranded due to the non-availability of cash in the ATMs and even Over-the Counters, while transactions over the apps have become a nightmare.

While in many cases, the apps do not open at all, in cases where they open, making a transfer becomes impossible. In other instances where the customer can transfer, the intended receiver does not get credited and this becomes a problem.

Speaking with a Lagos bank customer, Annie, said, “My two bank apps are currently experiencing problems. They are bringing error messages. And sometimes, the request take too long to process.”

“My attempt to get money from the Point of Sales attendants on the street is the same thing. Many of them have shut down due to their unavailability to get cash from the banks,” she added.

Another customer, Obe Comfort, who resides in the Gbagada area of Lagos State, lamented how the PoS attendants were taking advantage of the situation.

Comfort decried the hike in charges by the PoS operators being patronised by customers, adding, “They now charge as high as N300 on a N1000 transaction.”

I would have washed plates yesterday if someone hadn’t paid my bills- Customer

“I would have washed plates yesterday if someone hadn’t paid my bills after eating in a canteen. My hopes were high that I would do a transfer after patronising them not knowing that bank apps were currently down.

“It is a serious issue that needs urgent attention,” she added.

Meanwhile, an Ibadan-based trader, Mrs. Tajudeen Abike, who came on a visit to Lagos said she had closed down her shop as a result of the scarcity of naira and the challenges the bank apps were currently encountering.

She appealed to the Federal Government to find a lasting solution to the issue as things were going out of hand.

The situation seems worse in other remote areas as traders who usually come to the popular markets in the Mile 12 area of Lagos bitterly expressed displeasure and challenges faced in doing business.

One of the women, Mrs. Adefilani Sumbo, who volunteered to speak on their behalf, said their efforts to get cash to buy goods had been futile despite thinking that Lagos would not be experiencing the same problem because of the large number of banks in the state.

“We have queued at the ATM stand since morning despite the large crowd, thinking that we would get money to buy our goods.

“Out of the four ATMs here, only two are dispensing. We have spent all the money on us and are not sure if we will be able to get the goods we came here for, before going back to our towns,” she lamented.

Despite the Central Bank of Nigeria Governor, Godwin Emefiele, announcing a 10-day extension to the deadline to phase out the old currency, the scarcity of the new naira notes persists.

On Thursday, the apex bank directed commercial banks to start the issuance of the new naira notes in the banking halls.

While the CBN continues to claim it released more than enough new notes to the Deposit Money Banks, the reality on the ground points to the opposite.